Kaotim Customer Portal — Digitalising Takaful

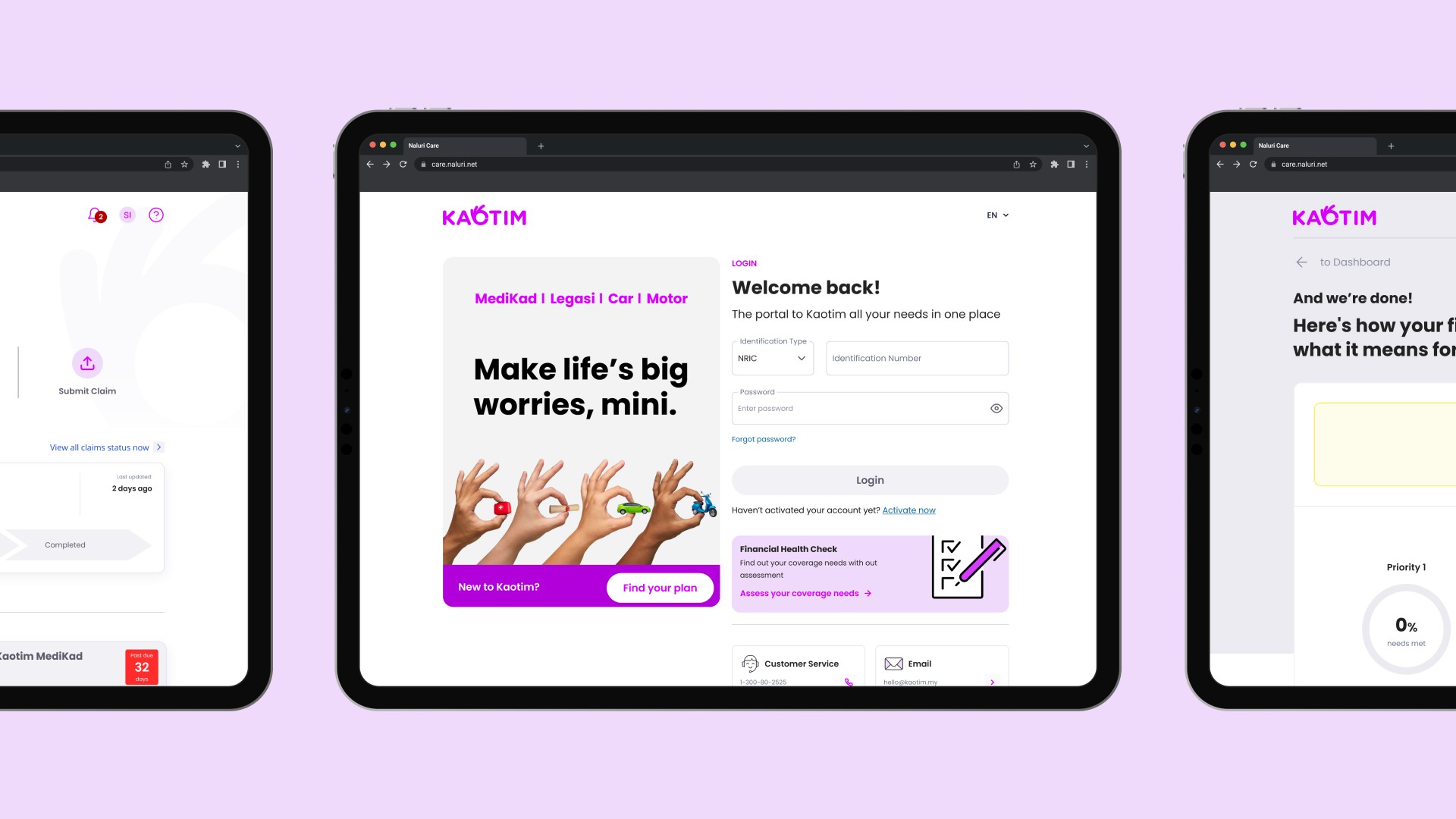

A new end-to-end customer portal for Takaful Malaysia’s digital arm, Kaotim.

Role

Lead Product Designer

Industry

Insurance & Takaful

Year

2025

DESIGN PROCESS: UNDERSTAND

To define what Kaotim should become, we first needed to understand what leading insurance players were already doing — especially those who’ve excelled in digital claims and frictionless customer experience.

Competitor & Market Analysis

I studied notable global players across insurance and digital health ecosystems, including:

Lemonade, Alan Health, Oscar Health, Root Insurance, Hippo Insurance, BIMA, ZhongAn Insurance, Ping An Insurance.

Key themes emerged

How top insurers modernise key processes

Speed = Trust

Fast approvals and transparent status updates directly drive customer satisfaction.Frictionless UX as a competitive advantage

Clear guidance, fewer steps, and strong automation lead to higher conversion and fewer errors.

How insurers cut claim time by 90%

Auto-approve smaller claims

Visual-first guided flows

Deep integration with hospital networks

Live status tracking

Modern guarantee letter (GL) standards

Self-service GL downloads anytime

Auto-send GLs directly to hospitals (Oscar’s approach)

Future-looking: blockchain as proof-of-issue

Blueprint for speed in digital insurance

Chat > forms: conversational UX helps users articulate needs faster

APIs > manual checks: real-time verification through JPJ, MiCare, hospitals

Track everything: transparency eliminates anxiety

OCR & AI triage: scan bills, extract data, reduce human handling

Provider integration: hospitals receive GLs instantly

Analytics loop: continuous optimisation

AI use cases that actually improve experience

Instant, low-friction claims (Lemonade-style ~5 min approvals)

Multilingual conversational support (“Am I covered for dengue?” in Malay/Manglish)

Automated guarantee letters with countdown timers

Reduced call-centre dependency and improved first-response time

These insights set the foundation for a fast, trustworthy, mobile-friendly digital Takaful experience.

DESIGN PROCESS: INSIGHT

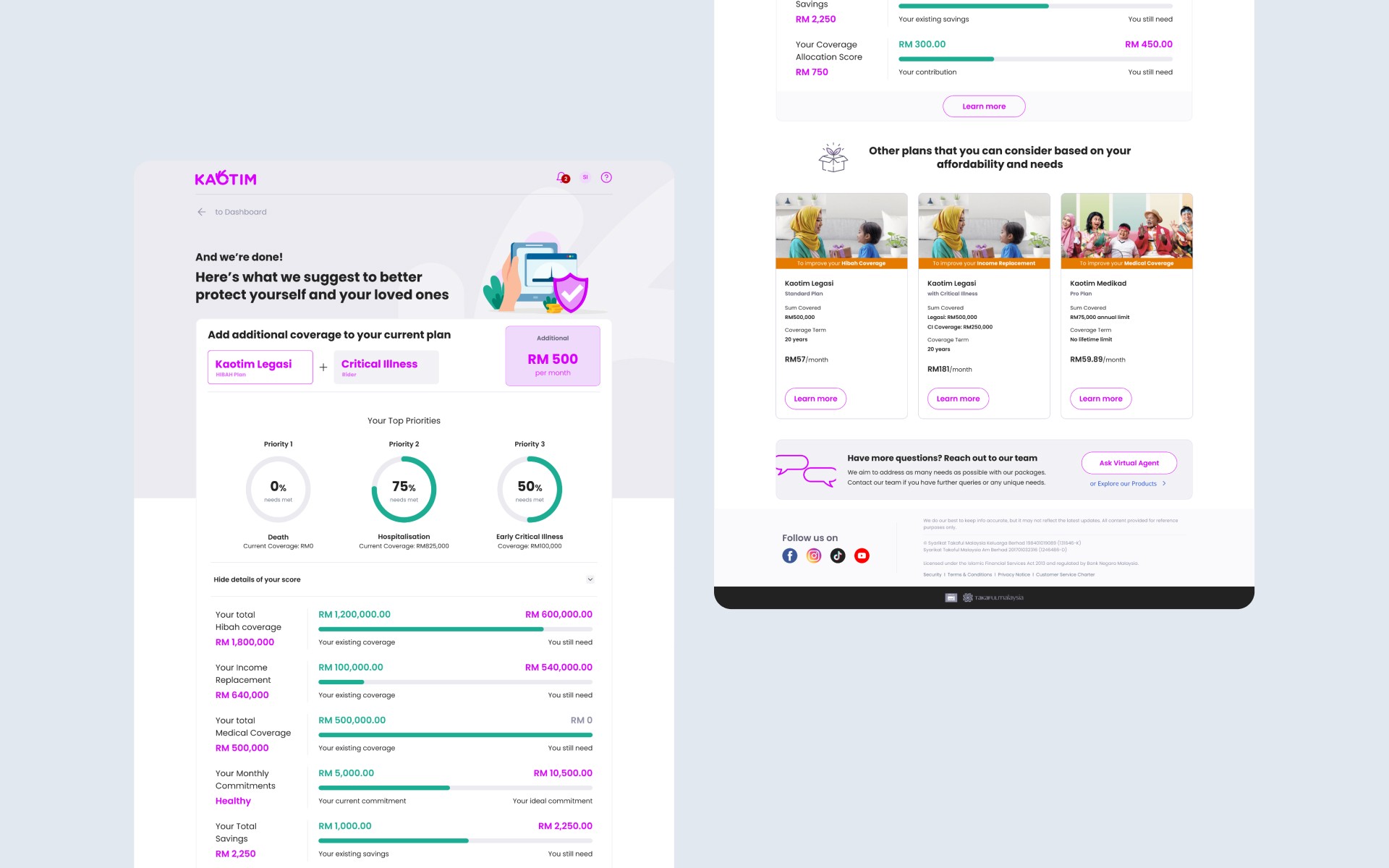

Translating the research into a design direction, a few core insights shaped the product:

1. Malaysian users equate speed with trust

Delays in claims or GL issuance are often interpreted as incompetence or avoidance. Reducing waiting time needed to be the north star metric.

2. The experience must remove “administrative fear”

Users often don’t understand insurance terminology or requirements.

→ Flows needed to guide visually, not overwhelm with text.

3. Self-service is the future

Users should be able to:

Download GLs instantly

Submit claims easily

View certificate details without calling an agent

Track everything in real-time

4. Automation is essential, even if not fully available at launch

Where integrations weren’t ready (MiCare, Merimen), we designed with the future in mind.

The portal still needed scalable foundations to support automation in future releases.

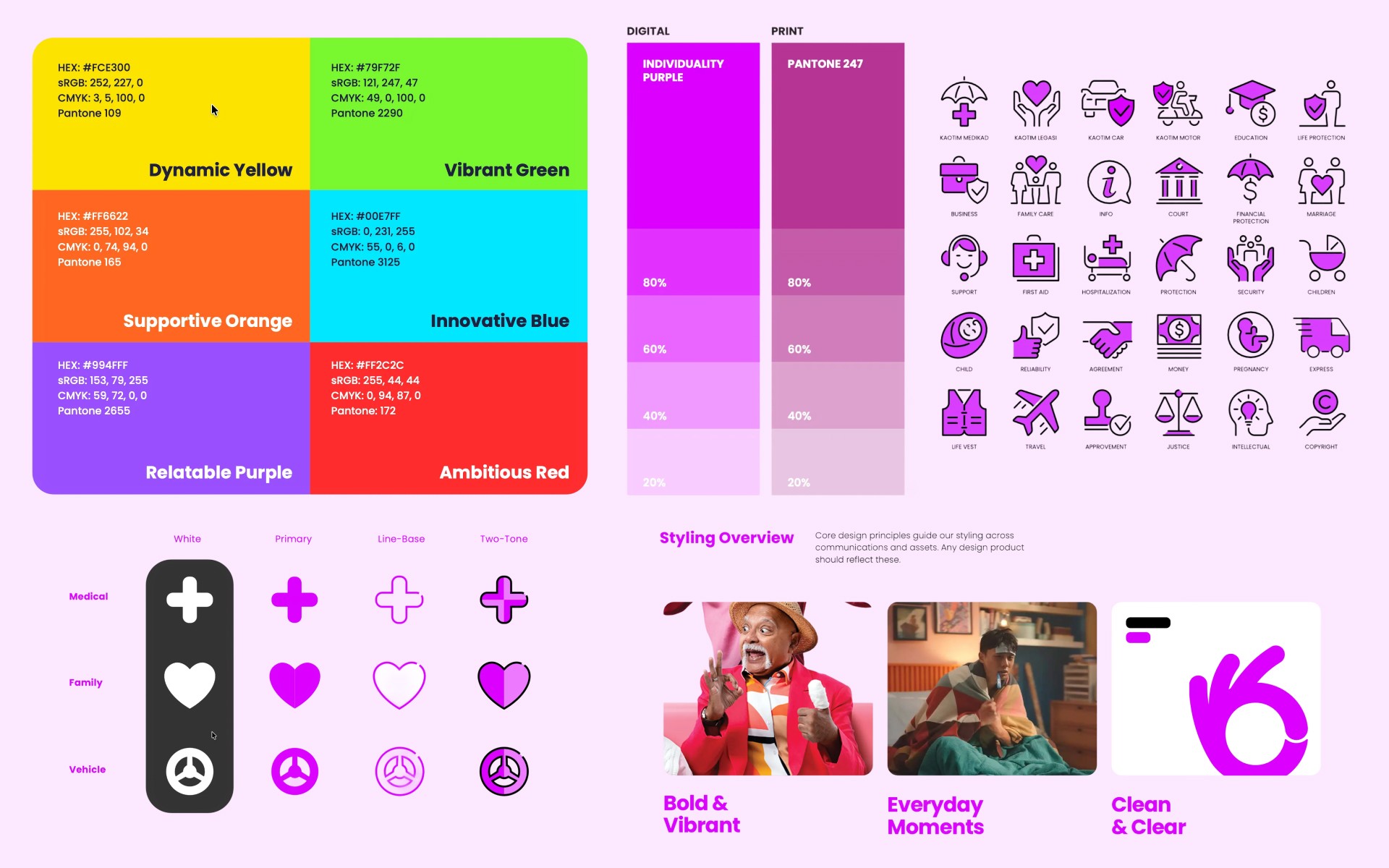

5. The portal must align with Kaotim’s evolving brand

Kaotim’s branding was still in refinement.

The design system needed to be flexible enough to adapt to future iterations.

These insights helped prioritise clarity, speed, and simplicity as the core product pillars.

DESIGN PROCESS: DESIGN

The design phase involved multiple rounds of ideation, stakeholder alignment, and component building.

Starting with inspirations

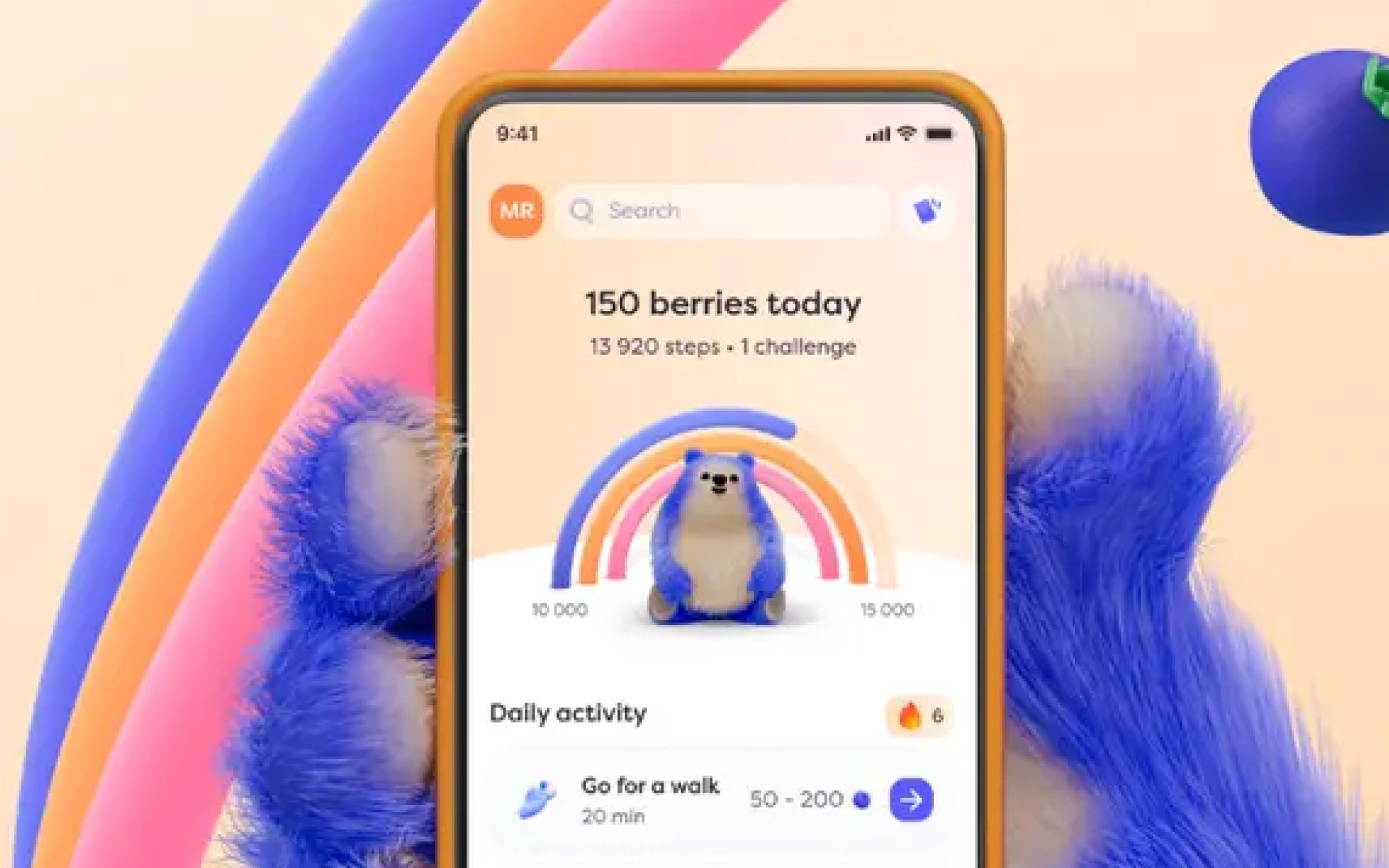

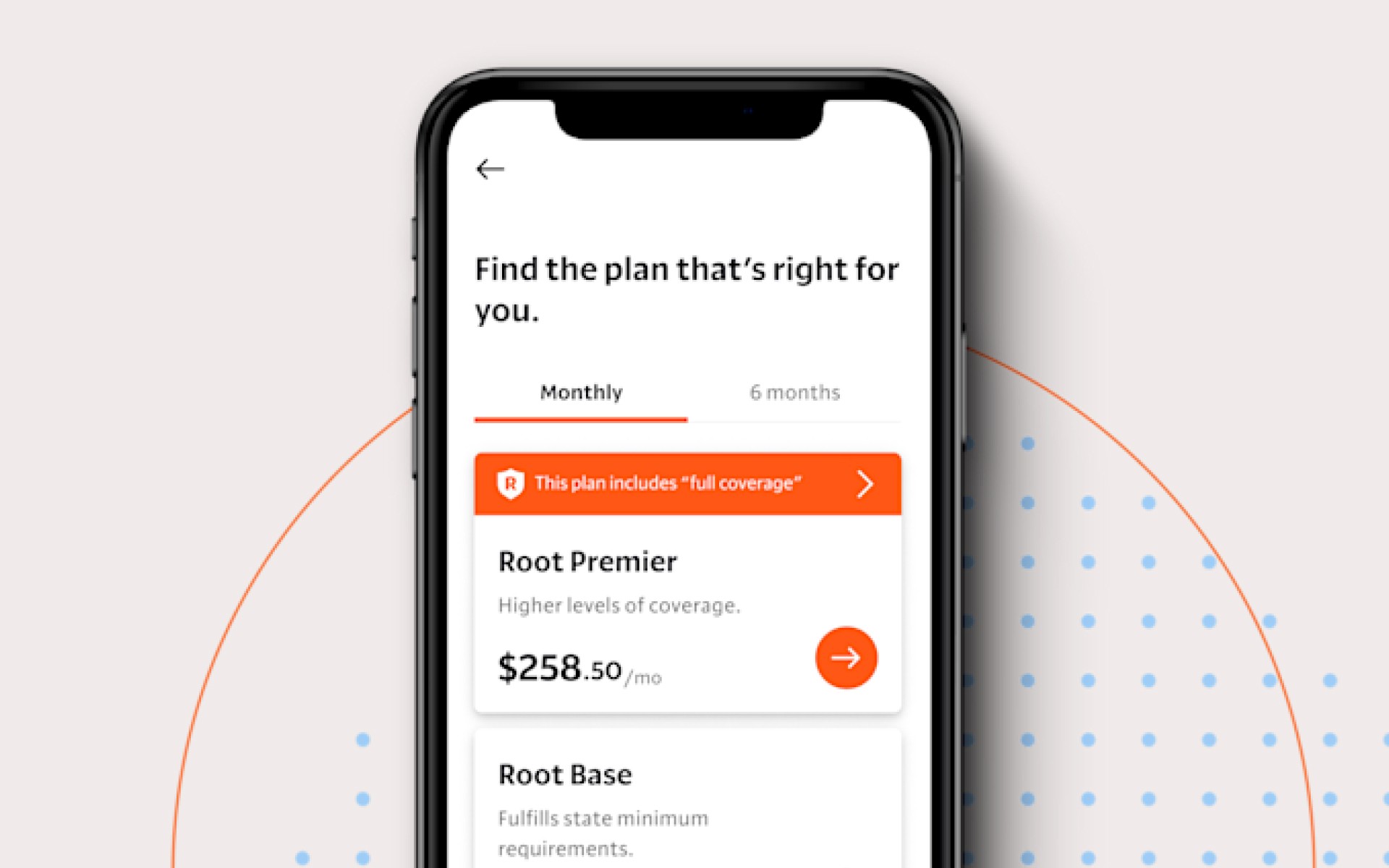

Using insights from Lemonade, Alan, Oscar, and Ping An, I explored design directions around:

clean, lightweight layouts

card-based information hierarchy

conversational guidance for complex flows

strong use of iconography

a warm, friendly colour palette aligned with Kaotim

Core features designed

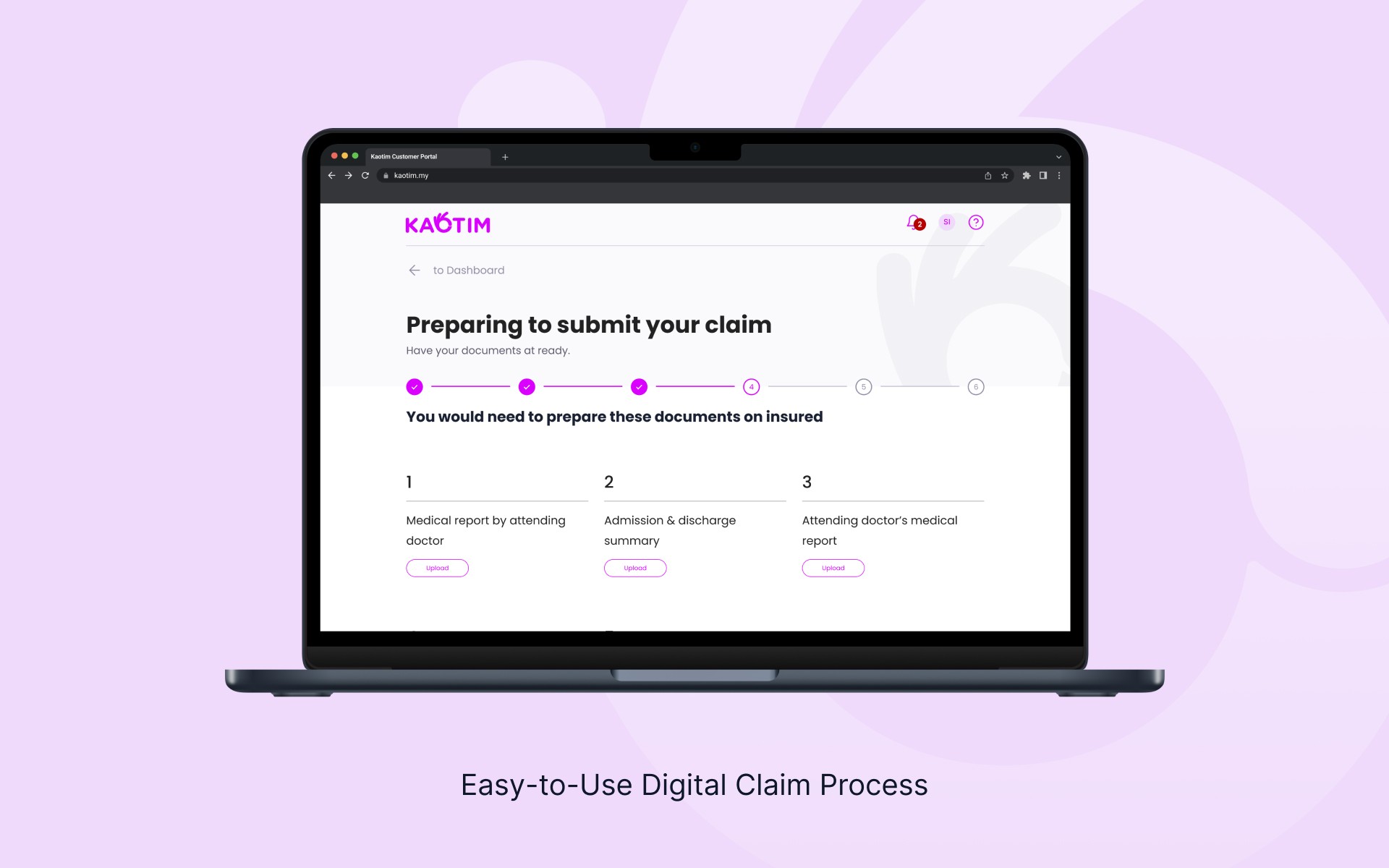

Claims submission flow

Guarantee Letter request flow

Certificate dashboard

Onboarding flow

Account management & preferences

Financial calculator

Stakeholder reviews

Throughout the process, designs were continuously shared with:

Kaotim Brand Team

PMO

Marketing

Product Manager

Engineering teams

This ensured alignment across branding, feasibility, and business requirements.

DESIGN PROCESS: VALIDATE

Because the platform had no existing customers yet, UAT (User Acceptance Testing) was conducted with Takaful Malaysia and Kaotim employees — the people most familiar with the processes.

Positive feedback

“The platform is easy to use.”

“Navigation feels straightforward.”

“I understand where to find everything.”

Key issues identified

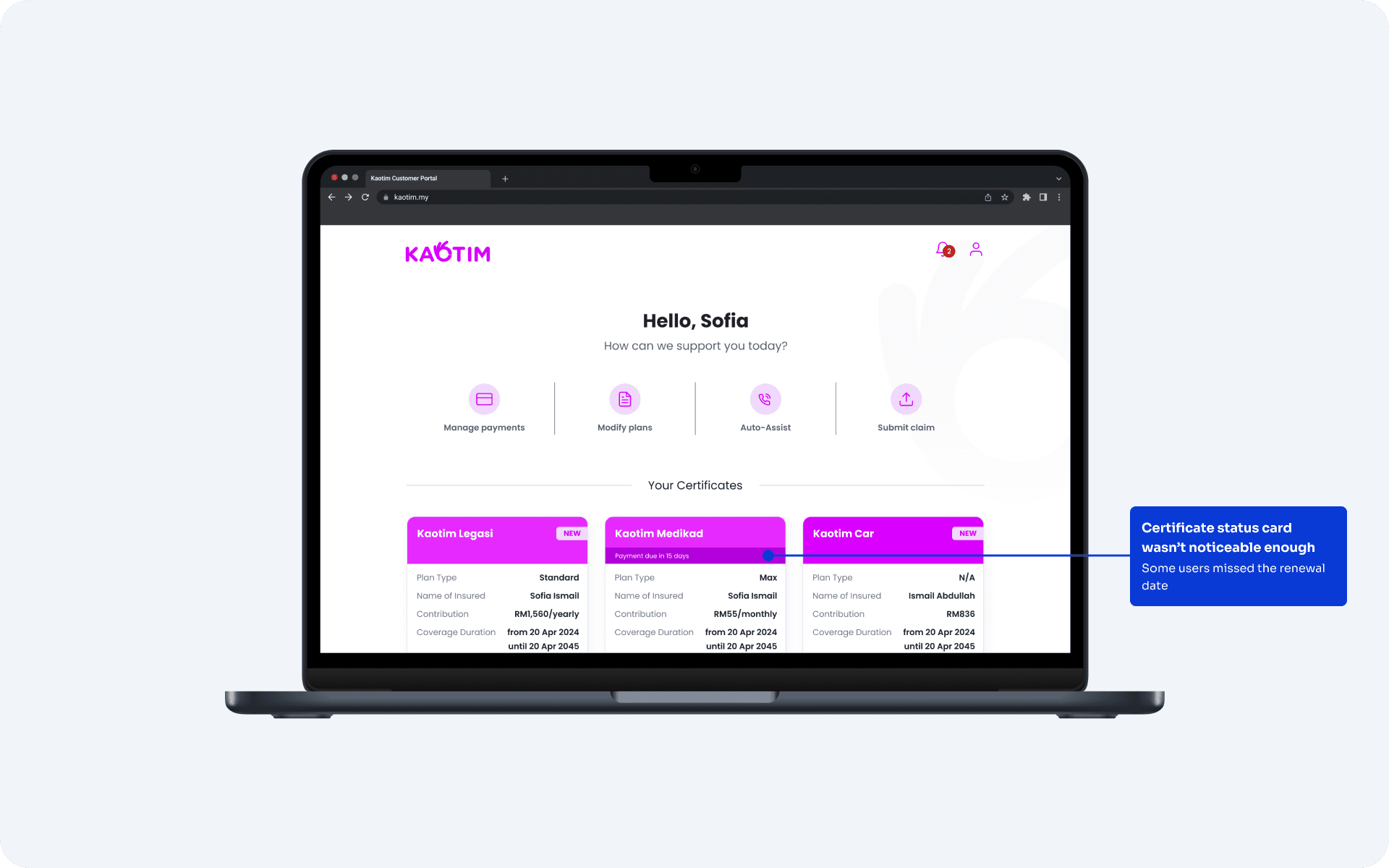

Certificate status card wasn’t noticeable enough

Some users missed the renewal date

Solution:

Added countdown

Adjusted colours for clarity

Synced with Kaotim’s updated brand palette

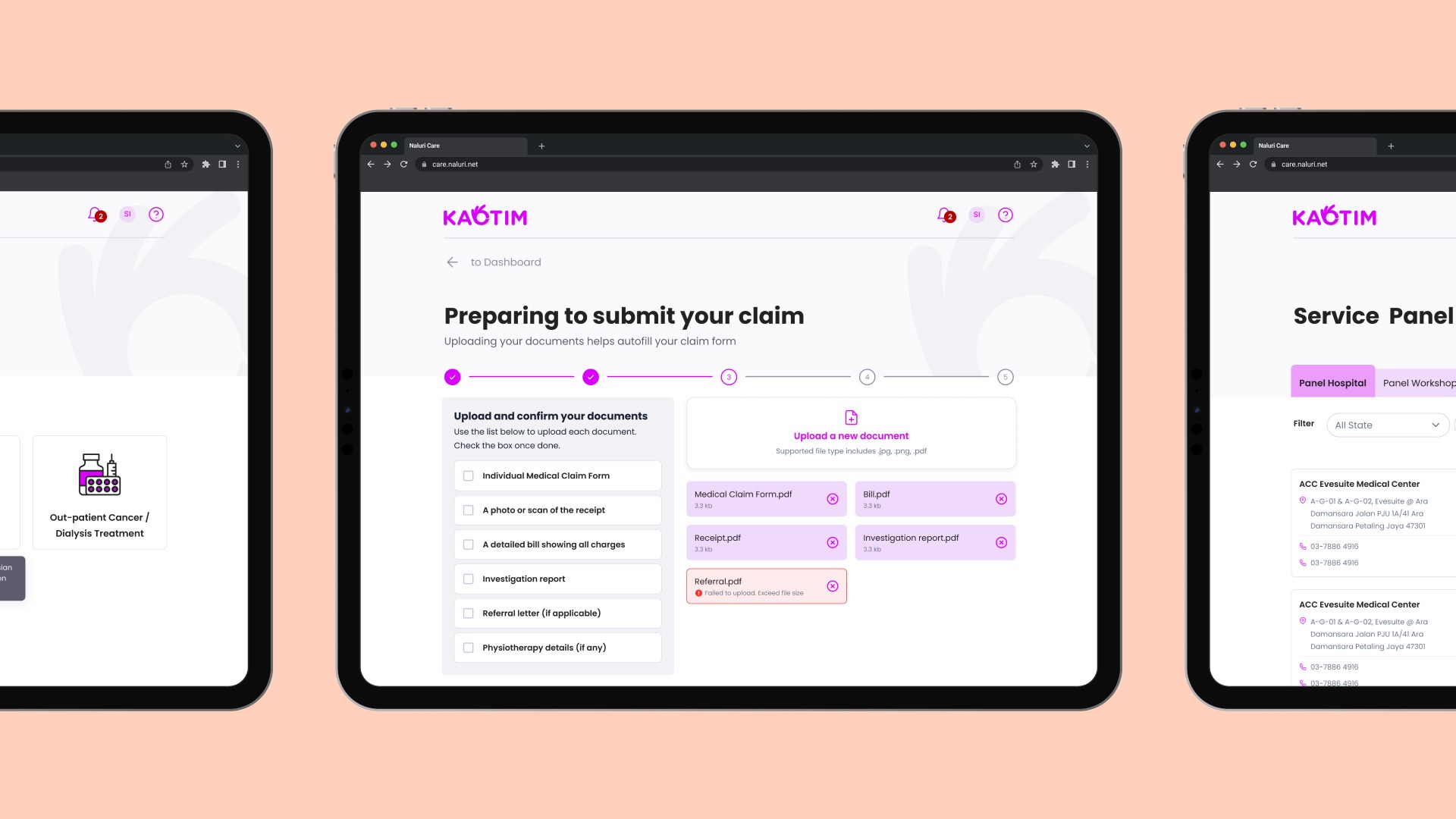

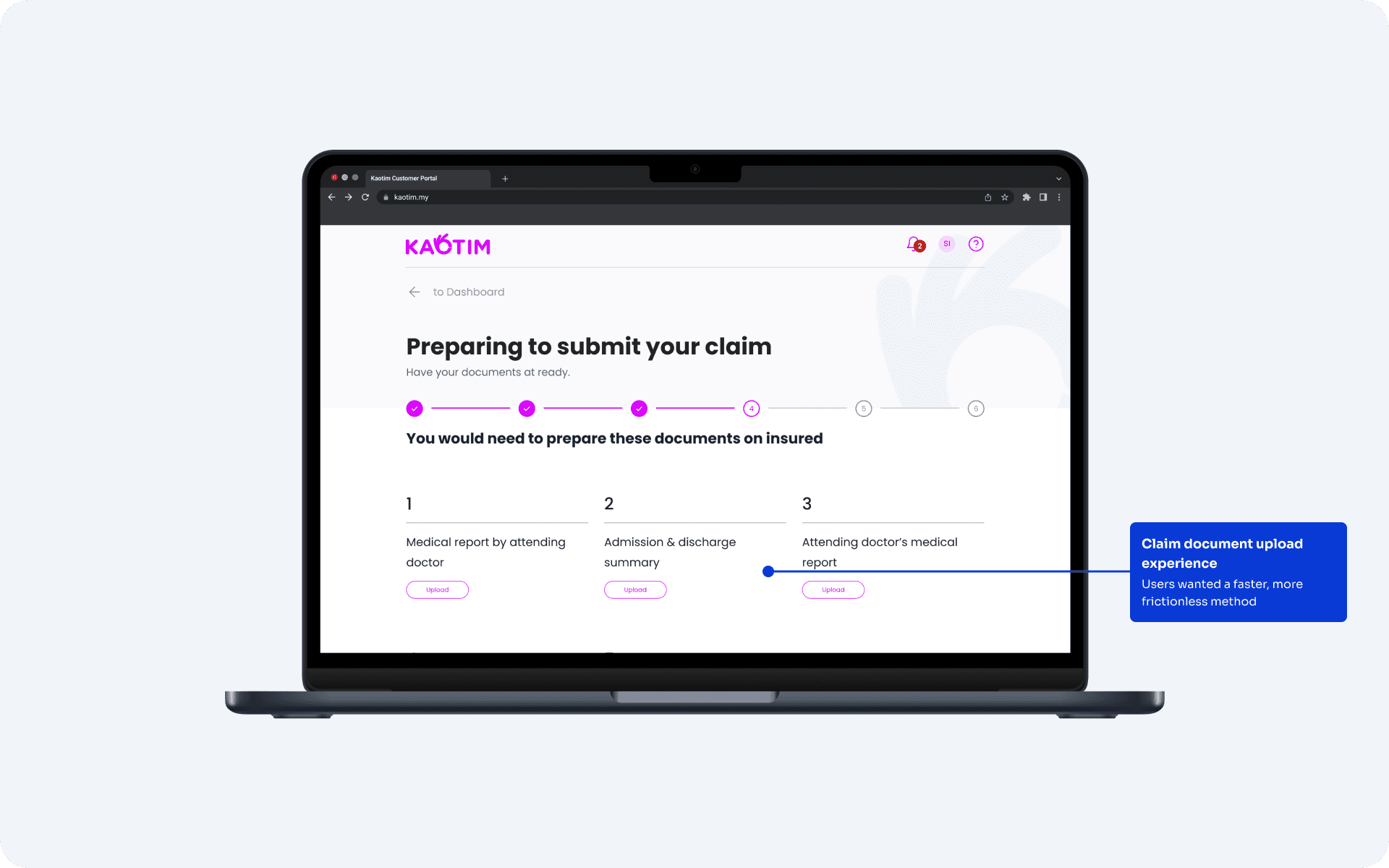

Claim document upload experience

Users wanted a faster, more frictionless method

Team agreed to use batch uploads instead of individual uploads

Tradeoff: the system can't auto-validate per document type

Decision: move forward with batch uploads for MVP

Addressed through clearer instructions & post-upload checklists

Overall outcome

The customer portal passed UAT with strong feedback, especially in:

overall ease of use

clarity of design

intuitive navigation

modern user experience

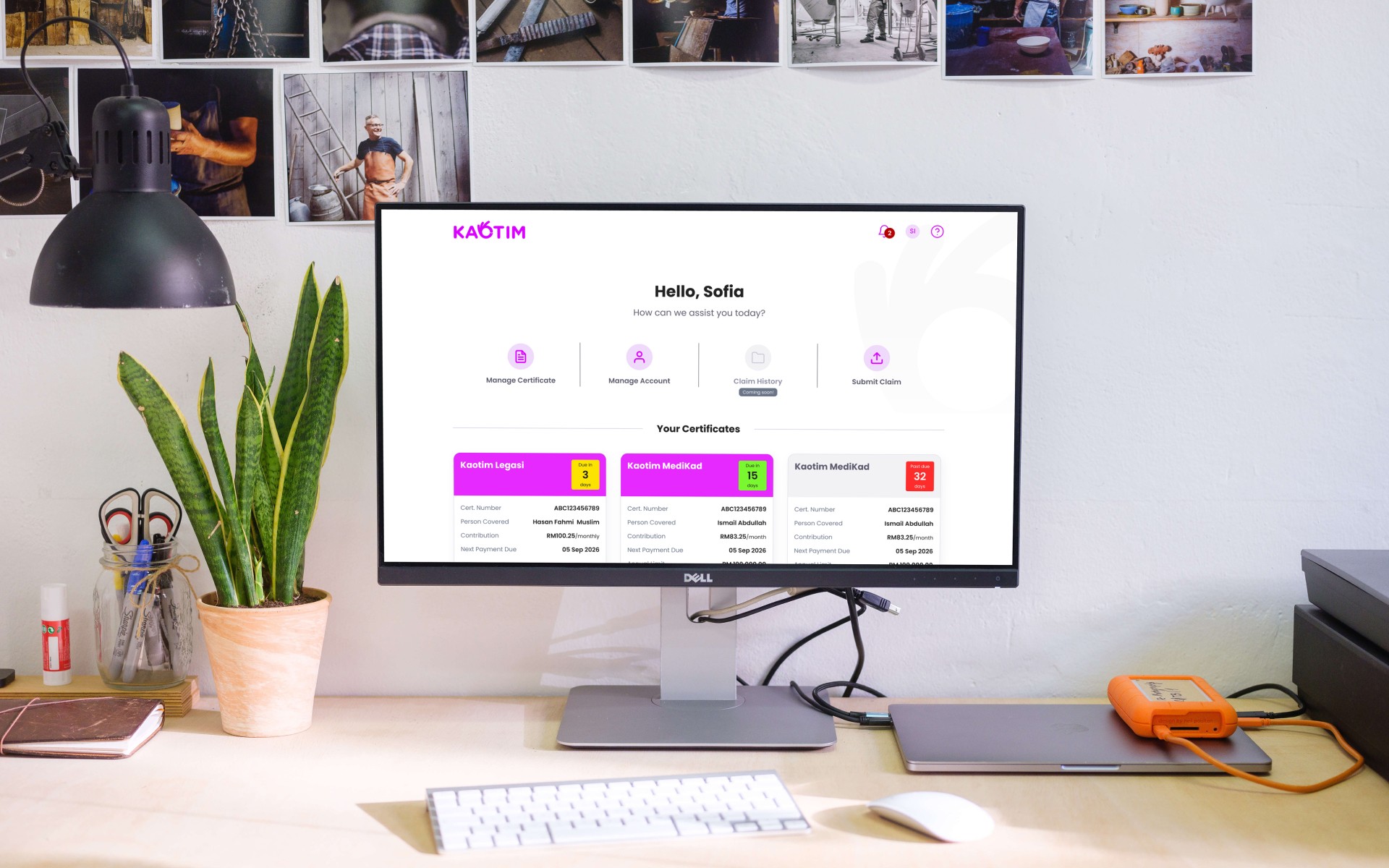

FINAL DESIGN

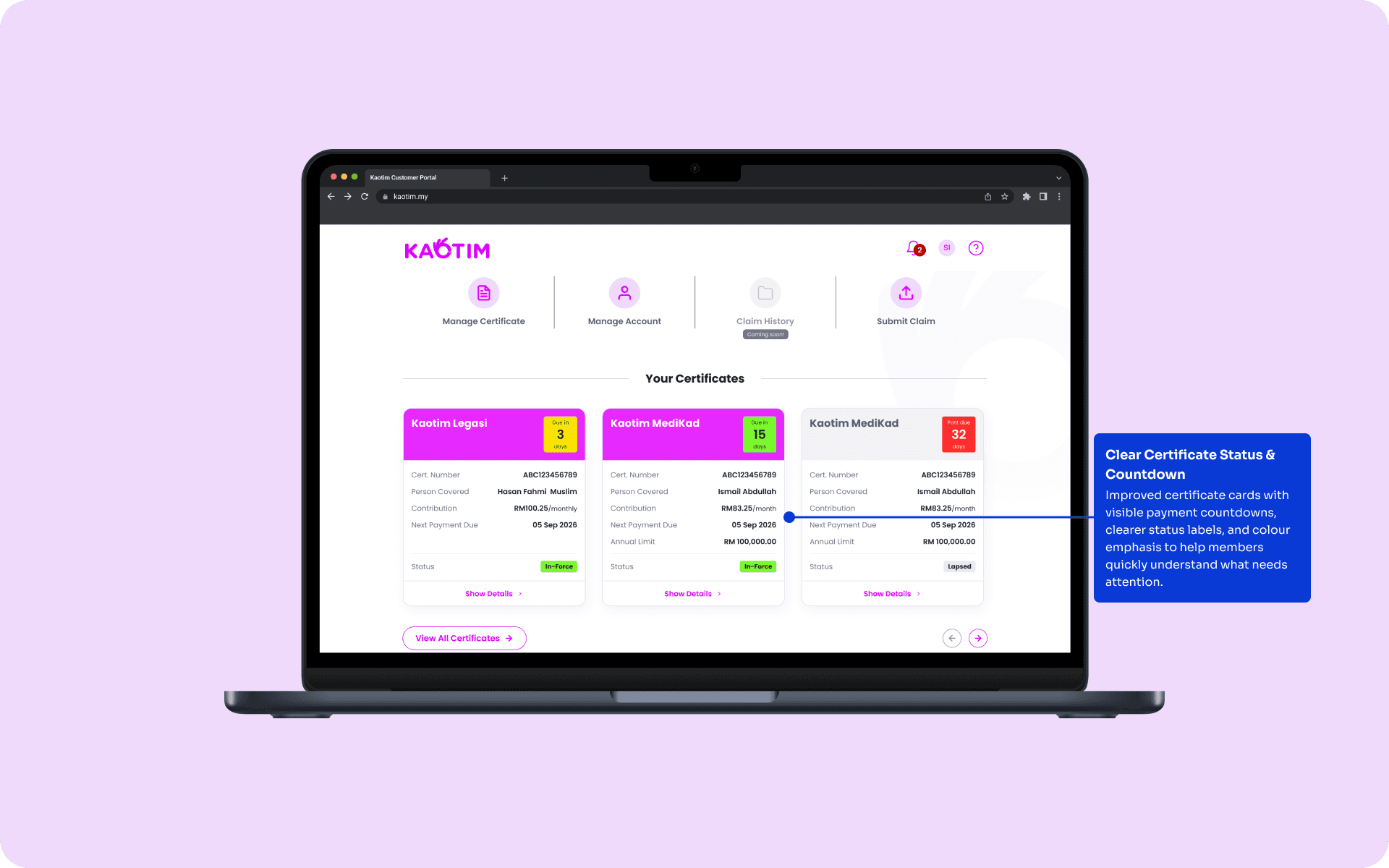

Refining the Experience Through Validation

Feedback from UAT directly informed key improvements across the platform. The certificate card was redesigned to better surface renewal and payment information by introducing a clearer countdown, more visible status indicators, and stronger colour emphasis on upcoming due dates. These changes were also aligned with Kaotim’s updated brand palette, finalised shortly before launch.

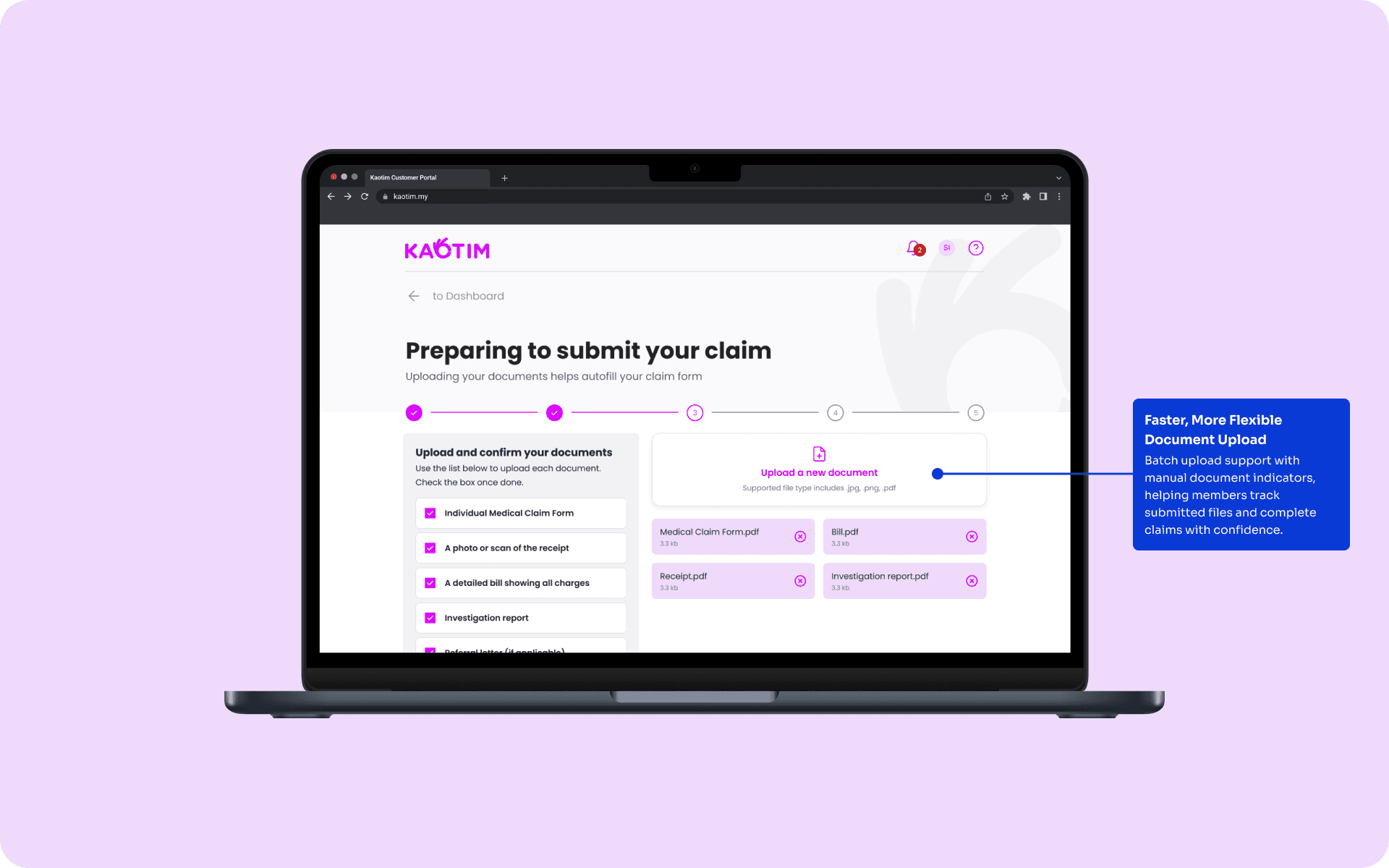

Simplifying Claim Document Uploads

The claim submission experience was simplified to reduce friction. Members can now upload multiple documents at once instead of individually. To support clarity, users can manually mark which documents they have uploaded, giving them a visual checklist to avoid missing any required files.

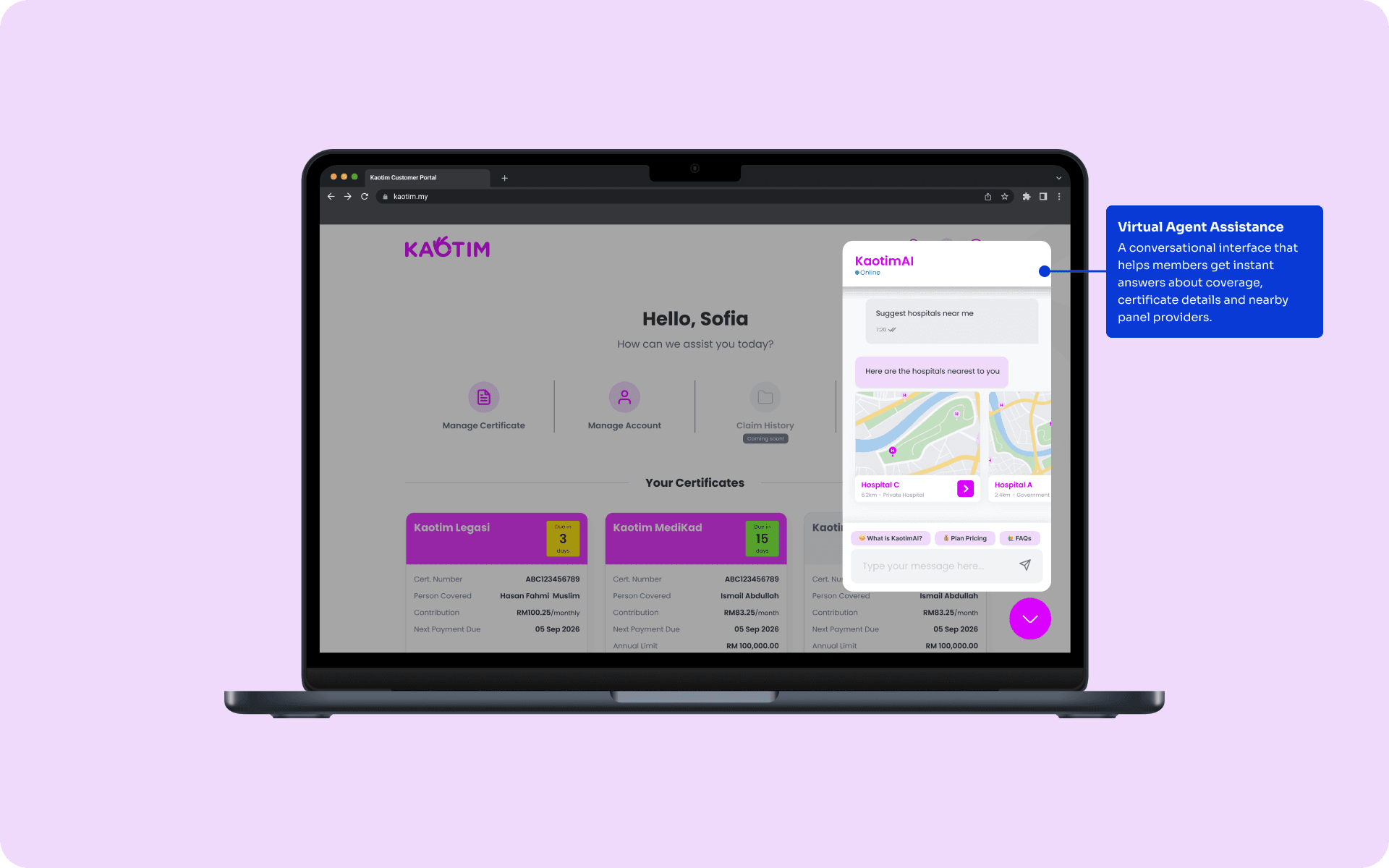

Virtual Agent for Self-Service Support

A Virtual Agent was designed to help members quickly find answers without navigating multiple pages. It supports questions related to certificate details, coverage, and locating nearby panel hospitals, clinics, or workshops.

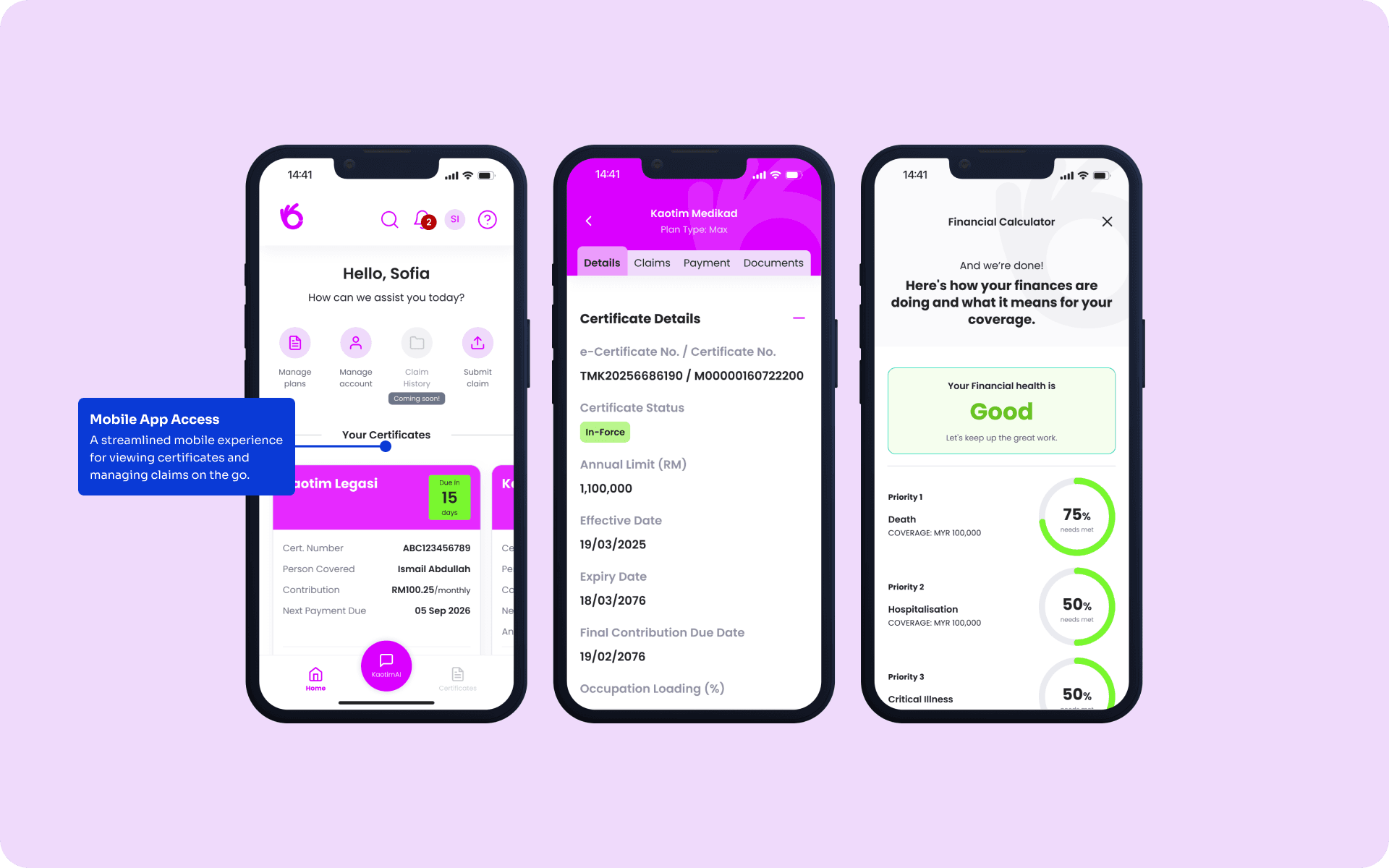

Mobile App Experience

To support on-the-go access, I designed a mobile app experience focused on quick certificate viewing, simple claim submissions, and easy status checks—making key actions accessible anytime, anywhere.

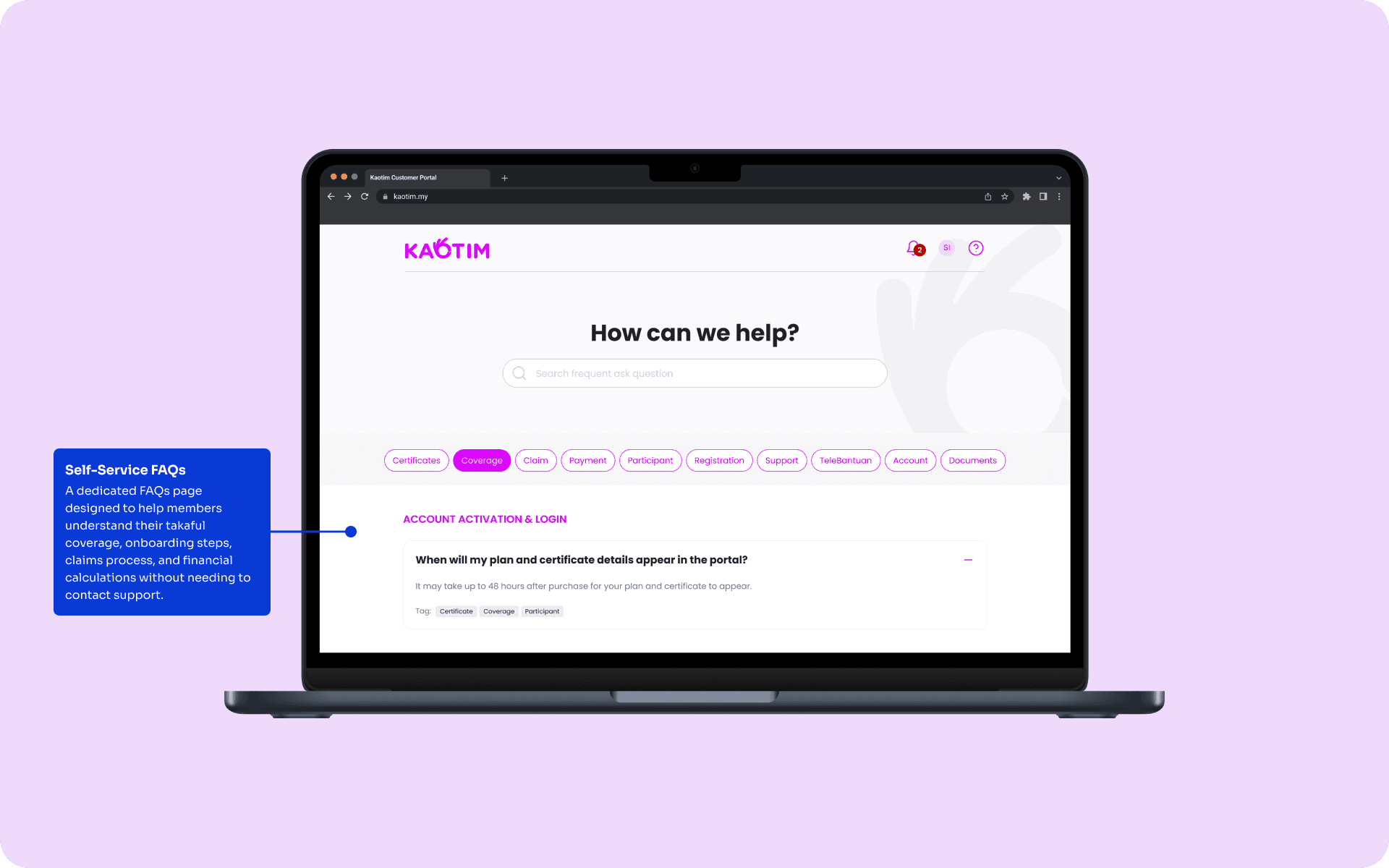

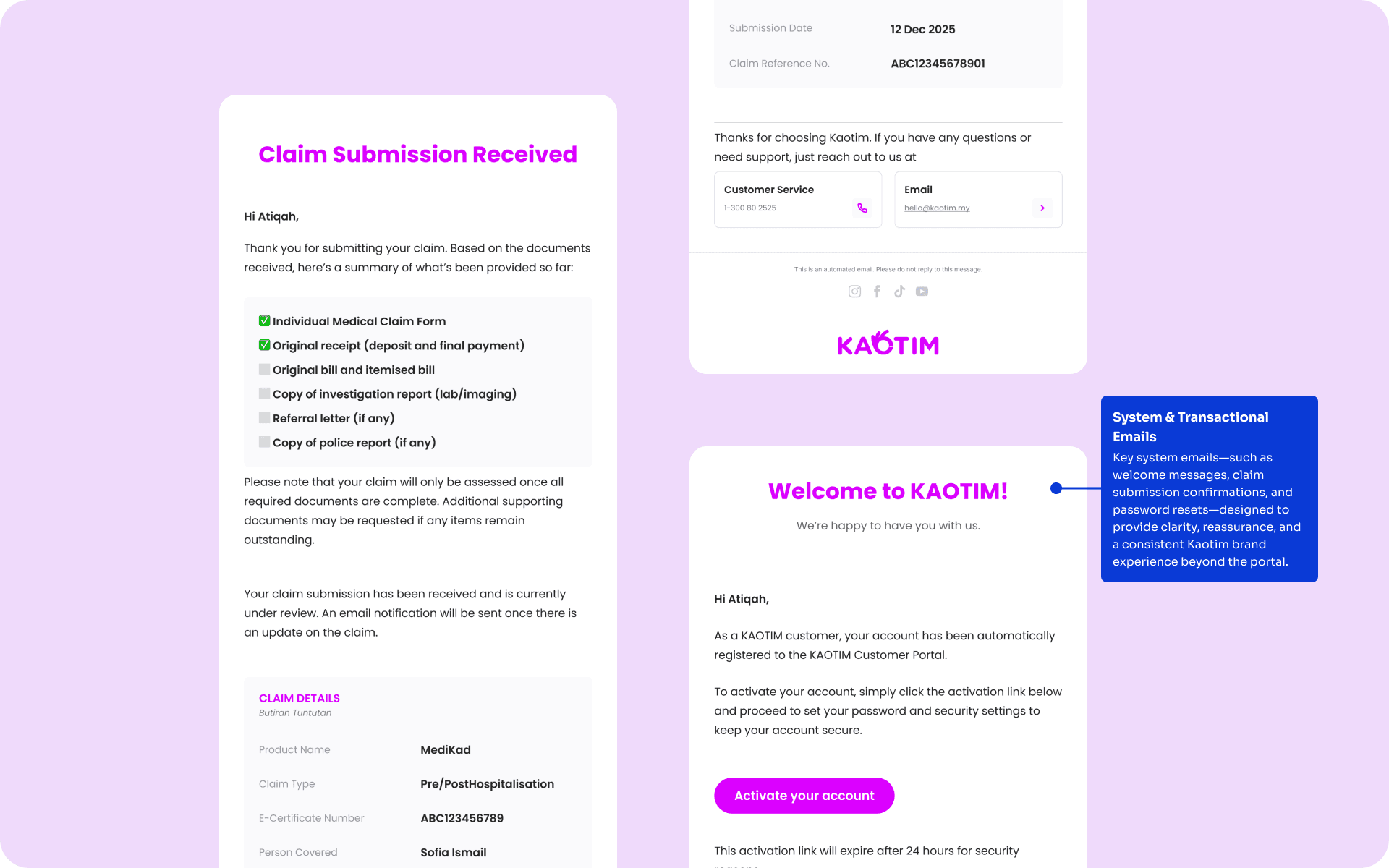

Supporting Pages & Communication

To reduce reliance on support channels, I designed a dedicated FAQs page covering takaful coverage, onboarding, claims, and financial calculators. I also designed key system emails, including welcome emails, claim submission confirmations, and password reset emails, to ensure a consistent experience beyond the portal.

Establishing the Design System

All final designs were consolidated into a structured design system, defining foundations, components, and patterns to ensure consistency and scalability. This system now serves as the backbone of the Kaotim Customer Portal and supports future features and market expansion.

Other projects

QuickBite – Bringing Local Flavor to the Doorstep

A localised food delivery experience designed for Nashville’s community.

Naluri App Experience Redefined

Enhancing Naluri’s interface and flow to drive engagement and user satisfaction

Naluri Coach Platform Reimagined

Transforming the Coach Platform to improve collaboration and coaching outcomes